TABLE OF CONTENTS

A. GS1 Related SOCIETY 1. Centre lists steps to end workplace harassment B. GS2 Related POLITY 1. Govt. ignoring the plight of children: SC INTERNATIONAL RELATIONS 1. India, UAE to deepen strategic ties, counter terror 2. Abu Dhabi temple 3. Asma Jehangir :A symbol of resistance, a votary of peace is gone C. GS3 Related ECONOMY 1. New Rubber Policy soon 2. Inter-govt. defence deals gain traction 3. Why the fuss about fiscal deficit? 4. Ministries may discuss govt. healthcare plan this month 5. Farm focus to spur housing 6. Cryptocurrency: ‘trustless’ nature irks regulators 7. RBI still processing returned notes 8. NITI bats for separate debt office at Centre ECOLOGY AND ENVIRONMENT 1. Three new eel species found in Bay of Bengal D. GS4 Related E. Editorials HEALTH ISSUES 1. States of health: A new index by NITI Aayog ECONOMY 1. Turf war F. Prelims Fact G. UPSC Prelims Practice Questions H. UPSC Mains Practice Questions

A. GS1 Related

1. Centre lists steps to end workplace harassment

- The Centre has informed the Supreme Court of its efforts to urge business associations like the ASSOCHAM and the FICCI to ensure effective implementation of the law to prevent sexual harassment at workplace.

- In an affidavit filed before a Bench led by Chief Justice of India Dipak Misra, the government said the States and the Union Territories were asked to organise workshops and awareness programmes on the law in every industry.

- The petitioner, Initiatives for Inclusion Foundation, represented by advocates Sanjay Parikh and Esha Shekhar, should file the suggestions for ensuring compliance with the Sexual Harassment of Women at Workplace (Prevention, Prohibition, Redressal) Act, 2013.

- Secretary, Industries/Commerce of the States/UTs, have also been advised to organise workshops and awareness programmes in each and every industry, business house, the private sector.

- It said an online complaint management system, called the sexual harassment electronic-box (SHe-Box), was developed for registering complaints of sexual harassment at workplace.

B. GS2 Related

1. Govt. ignoring the plight of children: SC

- The Supreme Court criticised the government for the tardy implementation of juvenile justice laws and ignoring the plight of the children of the nation.

- the Social Justice Bench described the authorities’ negligence of children, including the pendency of cases of orphaned, abandoned and surrendered children, the uncomfortable conditions of children in observation and care homes, the increasing number of vacancies in juvenile justice institutions and the lack of initiatives by legal services authorities despite the Juvenile Justice (Care and Protection of Children) Act, 2000, and its improved version passed in 2015.

Category: INTERNATIONAL RELATIONS

1. India, UAE to deepen strategic ties, counter terror

- India and the UAE will hold a bilateral naval exercise.

- The declaration came during Prime Minister Narendra Modi’s discussion with the leadership of the Gulf country with both sides agreeing to deepen the strategic partnership and counter terrorism in all forms.

- It explained that maritime security would be a crucial domain of India-UAE cooperation focussing on the Indian Ocean and the Gulf region.

- Apart from the announcement for joint maritime cooperation, Prime Minister Modi and the Crown Prince of Abu Dhabi, Sheikh Mohammed bin Zayed Al Nahyan, expressed joint commitment against tackling terrorism and threats to stability in the region.

- Making common cause against international terrorism, a joint statement issued at the end of Mr. Modi’s discussions with the hosts said, “The two sides deplored the adoption of double standards in addressing the menace of international terrorism and agreed to strengthen cooperation in combating terrorism both at the bilateral level and within the multilateral system. The two sides resolved to continue working together towards the adoption of India’s proposed Comprehensive Convention on International Terrorism in the United Nations.”

- Apart from a common intent to fight terrorism, both sides affirmed partnership on the cyber front and declared that joint research and development centres of excellence to fight cyber threats will be expedited.

- Both sides also reviewed contribution from UAE’s sovereign wealth fund ADIA (Abu Dhabi Investment Authority).

- Prime Minister Modi welcomed ADIA’s participation in India’s National Infrastructure Investment Fund as an anchor investor and welcomed DP World’s agreement with NIIF to create a joint investment platform for ports, terminals, transportation and logistics businesses in India

- It also witnessed a landmark concession to an ONGC-led energy consortium by ADMA-OPCO in lower Zakum oil fields of UAE.

2. Abu Dhabi temple

- Prime Minister Narendra Modi inaugurated a project for the construction of the first Hindu temple in Abu Dhabi, describing it as a “catalytic agent” of humanity and harmony that would become a medium of India’s identity.

- He laid the foundation stone for the Swaminarayan temple of the Bochasanwasi Shri Akshar Purushottam Swaminarayan Sanstha through videoconferencing from the Dubai Opera House, where he addressed the members of the Indian community.

2020 deadline

- The temple will come up on 55,000 square metres of land. The structure will be hand-carved by Indian artisans and assembled in the UAE. It will be completed by 2020 and open to people of all religious backgrounds.

- It will be the first traditional Hindu stone temple in West Asia.

- Sanstha, a socio-spiritual Hindu organisation set up in 1907. It runs over 1,100 temples and cultural centres around the world.

- The temple will be a replica of the one in New Delhi and another under construction in New Jersey.

- Noted Pakistani lawyer Asma Jehangir, who pas

3. Asma Jehangir :A symbol of resistance, a votary of peace is gone

sed away recently, was the country’s symbol of human rights and resistance and a fierce opponent of military dictators for over five decades. - She was also a vocal advocate of India-Pakistan peace and was part of several ‘Track 2’ delegations to India.

- She soon became a champion democracy activist and was subsequently imprisoned in 1983 for participating in the Movement for the Restoration of Democracy against the military rule of Zia-ul-Haq.

- She also served as chairwoman of the Human Rights Commission of Pakistan, and was widely respected for her outspoken criticism of the country’s militant and extremist Islamist groups.

- Jehangir also served as president of the Supreme Court’s Bar Association and was a UN rapporteur on human right and extrajudicial killings. She was once on Time magazine’s list of 100 most influential women.

- She often defended minority Christians charged with blasphemy, an offence that under Pakistan’s controversial law carries the death penalty. She was repeatedly threatened by the country’s militant religious right whom she criticised loudly and often.

- Jehangir has also taken up cases of missing persons and fought in the courts for their recovery free of cost.

- She played an active role in the famous lawyers’ movement in 2007 to restore Iftikhar Chaudhry as the Chief Justice of Pakistan. The movement later brought the fall of then President Gen. Pervez Musharraf.

- Of late, she had been critical of the Supreme Court for its ‘judicial activism’ and had also criticised the apex court for disqualifying Nawaz Sharif from the office of Prime Minister in July last year.

- She won numerous national and international awards for her struggle for the oppressed including the highest civilian honours Hilal-i-Imtiaz and Sitara-i-Imtiaz.

C. GS3 Related

1. New Rubber Policy soon

- The Central government will soon come out with a new Rubber Policy which will ensure remunerative prices for natural rubber.

- All issues, including minimum support price for natural rubber, possibility of introducing Minimum Import Price for the produce, and concerns over introduction of BIS for cup lump as a precursor to its import, would be looked into before formulating the policy.

- It was the UPA government that agreed to list natural rubber as an industrial raw material instead of as an agriculture product.

- The Central government had brought in anti-dumping duty for tyre imports from China.

2. Inter-govt. defence deals gain traction

- Government-to-government deals have become the preferred route to conclude major defence contracts and will remain so in the face of unending delays in defence modernisation.

- Several deals are being lined up for likely conclusion through inter-governmental agreements (IGA), some of which can happen this year.

- Defence Procurement Procedure (DPP) remains cumbersome and deals invariably get delayed. For instance, the Navy’s multi-role helicopter (MRH) tender for 16 helicopters, which began in 2009, was stuck over cost negotiations with Sikorsky for over two years due to price escalation. The Navy cancelled the tender last year and a fresh tender for 24 MRHs will be issued shortly.

- Similarly, the Army’s Spike Anti-Tank Guided Missile (ATGM) tender was cancelled last year after protracted negotiations.

- Last month, the Defence Acquisition Council (DAC) cleared the procurement of 72,400 assault rifles and 93,895 close quarter battle (CQB) carbines for Rs. 3,547 crore on a fast-track basis. Both the deals have been repeatedly cancelled.

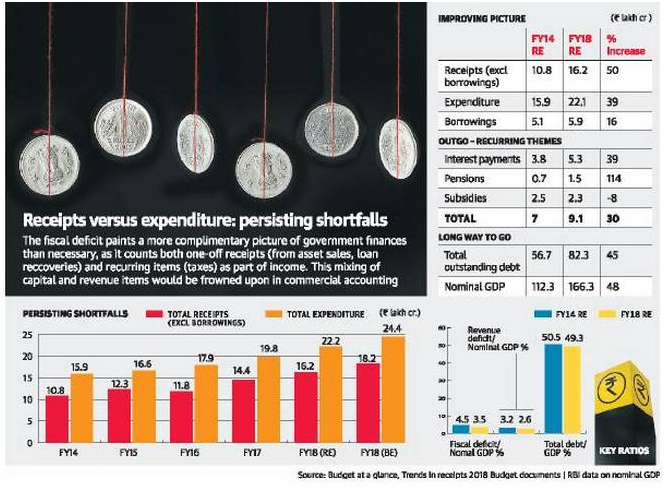

3. Why the fuss about fiscal deficit?

- To any layman watching India’s annual Budget jamboree, the entire exercise must seem very puzzling.

- After the Finance Minister has read out a long list of giveaways to farmers, small businesses, low-income earners and senior citizens in his speech, none of the beneficiaries seems entirely happy with their gifts.

- Think of India’s central government as one sprawling household with the Ministries, State governments and citizens making up its family members.

Expenses overshoot

- In FY18, the Centre’s total income (as per the revised estimates) from taxes, non-tax revenues and capital items is estimated at Rs. 16.23 lakh crore.

- But it expects to incur a total expenditure of Rs. 22.17 lakh crore. Expenditure will thus overshoot income by about 36.5%, leaving a shortfall of Rs. 5.94 lakh crore.

- This Rs. 5.94 lakh crore shortfall is euphemistically termed as the fiscal deficit. When it is expressed as a percentage of India’s nominal GDP (Rs. 167 lakh crore as per latest CSO estimates), it appears modest at 3.5%.

- But this tells you why even a minor slippage in the fiscal deficit is so keenly watched. A 30-basis point overshoot in the deficit means a Rs. 50,000 crore hole in the Budget.

- The fiscal deficit in fact paints a more complimentary picture of government finances than necessary, because it counts both one-off receipts (from asset sales, recovery of loans etc) and recurring items (taxes) as part of the government’s ‘income’.

- This mixing of capital and revenue items would be frowned upon in commercial accounting. Therefore, if one excludes capital items and takes stock of revenue items alone, the Centre is still spending more than it earns, with a revenue deficit of Rs. 4.39 lakh crore in FY18 (revised estimates).

- But the fiscal or revenue deficits for FY18 are by no means standout numbers. India’s fiscal deficit in the past ten years (based on actuals) has hovered between 3.5% and 6.4% of nominal GDP.

Borrowings mount

- Like your typical householder, when the Centre ends up spending more than it earns, it takes recourse to market borrowings to bridge the gap. The borrowing target for the year is closely watched by the bond market because the larger the government’s loan-taking, the less room for other borrowers — companies, small businesses, individuals — to raise funds from India’s relatively shallow bond market.

- Many years of such profligacy had led to the Indian government sitting on a significant stockpile of debt. By end-March 2018, the outstanding loans of the Central government are estimated to hit Rs. 82.32 lakh crore. That’s up from Rs. 57 lakh crore five years ago and amounts to 49.3% of the nominal GDP. The saving grace is that the bulk of those loans are from domestic sources, with just Rs. 2.4 lakh crore owed to foreign lenders.

Unproductive spends

- If the government’s expenditure routinely overshoots its receipts and budgeted estimates, why is there so much angst about the under-allocation to welfare schemes?

- The answer lies in the extremely limited elbow room that the Centre enjoys in deciding on its Budget allocations.

- While allocations to pet schemes may take up a lot of time in the Budget speech, the reality is that the bulk of the expenditure each year is absorbed by just three recurring items — interest payments, pensions and subsidies. In the FY18 revised estimates, for instance, interest payments (by far the largest item of expense) were expected to absorb Rs. 5.3 lakh crore, pensions Rs. 1.5 lakh crore and subsidies Rs. 2.3 lakh crore.

- In short, servicing interest payouts alone will take up 32% of the Centre’s earnings this year, while pensions and subsidies absorb another 23%.

- With 23% allocated to State grants and 16% to defence expenditure, these repetitive expenses will effectively mop up 95% of the total Budget receipts.

- This makes it evident why there’s so little room in the annual Budget for allocations to new ideas or schemes.

- The other long-lamented problem with the expenditure pattern is that the bulk of the Budget spending goes into consumption or maintenance expenses, with very little spent on creating new assets.

- In FY18, just 12% of the budget was defrayed in capital spending.

- It is important to emphasise here that while we have cited FY18 numbers in the above analysis, all of the above problems have been long-standing ones for the fisc.

- This is indeed why there’s a Fiscal Responsibility and Budget Management (FRBM) Act which enjoins the government to steadily tighten its fiscal and revenue deficits over the years, while reining in its debt-GDP ratio.

- What the analysis tells us is that, for India’s government to be really able to launch bold new schemes or make a difference to citizens’ welfare, it needs to clean up its finances first — pare down debt, save on interest payouts, reduce pensions and subsidies and raise asset creation.

- It must also ensure that its receipts grow at a far faster pace than expenses in future, so that the debt can be paid down.

- Therefore, the success or failure of the annual Budget exercise really has to be measured on the progress in these parameters over the years.

Progress since FY14

- So what has been the progress on fiscal consolidation post-FY14, when the current NDA regime was voted into power? On this score, there’s good news to impart.

- For starters, in the four fiscal years between FY14 (the last Budget by the UPA government) and FY18, the Centre’s receipts have grown at a faster pace than its expenditure. Using revised estimates for both years, the Centre’s total receipts (excluding borrowings) have shot up by 50% between FY14 and FY18. Total expenditure in the same period registered a slower 39% increase. Even better, spending on interest, pensions and subsidies rose by a much lower 30%, thus freeing up room for other expenditure.

- Two, the brisk pace of growth in receipts vis-a-vis expenses helped the Centre avoid a big bloat in the fiscal deficit over these four years. With the number edging up from Rs. 5.2 lakh crore in FY14 (RE) to Rs. 5.9 lakh crore by FY18 (RE), fiscal deficit as a percentage of GDP has declined from 4.5% to 3.5%. In fact, it would be even lower but for the spike in FY18.

- Three, the reined-in deficit has meant lower recourse to borrowings in order to bankroll spending. In FY14, as much as 32% of annual Budget spending came from borrowings, but by FY18 it was down to 27%.

- But all this frugality has made only a mild dent in the Centre’s stockpile of debt, which has dipped only from 50.4% to 49.3% of GDP over four years.

- Now, pessimists will point out that even the progress achieved so far is glacial and that there’s a long way to go before India’s government finances are in the pink of health.

- This is why it is so critical for this government to stick to its path of fiscal consolidation in the last year of its five-year term and not give in to populist temptations.

4. Ministries may discuss govt. healthcare plan this month

- The Ministries of Finance and Health will hold the first meeting this month on the National Health Protection Scheme (NHPS) to discuss the modalities of its implementation, including whether to rope in insurance firms or set up a trust to settle claims.

- The scheme, which would be the world’s largest government healthcare programme, was announced in the 2018-19 Budget for providing medical cover of up to Rs. 5 lakh to more than 10 crore poor and vulnerable families, constituting 40% of India’s population. “It would be deliberated on whether National Health Protection Scheme will be run through a trust-based model or through general insurance companies,” an official said.

- State-level models

- Certain States are already successfully running healthcare schemes using the trust-based model. Under this model, a trust will be set up by the government with funds being contributed by the Centre and States, which will settle hospital claims of beneficiaries, instead of insurers settling them.

- The Health Ministry will draft the scheme, which is likely to be unveiled either on August 15 or October 2, after consultations with the States. There are States which run schemes for specific illnesses and discussions would include ways to streamline those with NHPS.

- The Health Ministry would discuss with States on how to go about with the existing state-run schemes once the NHPS is implemented. At the central level, the Rashtriya Swasthya Bima Yojana would be subsumed within NHPS.

5. Farm focus to spur housing

- It was expected that there would be a strong focus in the Budget on rural and the agriculture sector.

- Nominal income of the agriculture sector has hardly grown in the last three years. In our zest for stock markets and global business, we should not forget the farmers. They had brought this fact to the notice of our government in the Gujarat elections.

- The proposed increase in Minimum Support Price (MSP) was much needed. Interestingly, higher income in the hands of farmers would boost consumption as well as demand for rural housing. There are several other initiatives for the rural sector such as the rural market, operation green, and iniatiatives in husbandry.

- The Budget envisages a major jump in loans to self-help women groups and also spending on schemes like Ujwala, Saubhagya and Swachh mission for LPG connection, electricity and toilets. The Budget provision for Rs. 14.34 lakh crore for rural infrastructure, if spent well, will make a positive difference to our rural folk.

- One must commend the government for thinking big and proposing to cover 50 crore people by introducing the world’s largest health protection scheme. The cost of this mega health plan will be shared by Centre and States and is more than covered by the 1% increase in health and education cess.

- Effective tax rate rises

- The cess further increases the effective tax rate for large corporates. Still, increase in threshold of turnover from Rs. 50 to Rs. 250 crore for lower corporate tax of 25% is a big boost for a large number of enterprises.

- There is impressive increase in the outlay for roads, infrastructure, railways and education. This would give a further fillip to economic growth.

- There is some relief for salaried tax payers who end up paying more taxes than self-employed people who get away understating their income. It has not been often that government has been able to meet ambitious disinvestment targets.

- The Finance Minister has kept next year’s disinvestment target a bit lower than the realisation seen this year. It does provide the necessary cushion should there be a shortfall in some revenue heads or excesses in expenditure.

- For the recent fall in stock market indices, I do not think only the long-term capital gains (LTCG) tax is to blame. A 10% LTCG tax by itself is not so bad. But we should not forget that when STT was introduced, that was in lieu of lower taxes on capital gains. That is the problem with our Indian tax system.

- In principle, we are all okay that people making more money may be taxed more. But, we should not make it very complicated just to make it optically look better.

- The government should have removed STT, as levying both the taxes at the same time will hit liquidity in the market. It’s a pity that STT remains and LTCG tax is back. It’s okay to tax LTCG but STT should be removed.

- Investors who have bought shares in last one year, assuming they hold them to complete one year, will get the benefit of grandfathering. Therefore, smart provisions can actually reduce selling pressure.

- The Budget does make serious attempts to meet the expectations of all constituencies. And despite LTCG, equity remains the best asset class in the medium- to long-term.

6. Cryptocurrency: ‘trustless’ nature irks regulators

- Last October, the Board of the International Organization of Securities Commissions (IOSCO) discussed the growing usage of Initial Coin Offerings (ICOs) to raise capital as an area of concern.

- The world body also said that ICOs are highly speculative investments in which investors were putting their entire invested capital at risk.

- To be fair, some operators provide legitimate investment opportunities to fund projects or businesses.

- But, the increased targeting of retail investors through online distribution channels by parties often located outside an investor’s home jurisdiction — which may not be subject to regulation or may violate laws — raises investor protection concerns.

- In Budget 2018, Finance Minister Arun Jaitley said the government did not consider cryptocurrencies legal tender and would aim to eliminate their use in financing illegitimate activities.

- Many regulatory and self-regulatory authorities globally have cautioned investors on ICOs.

- ICOs, also known as token sales or coin sales, typically involve the creation of digital tokens — using distributed ledger technology — and their sale to investors in return for a cryptocurrency such as bitcoin or ether.

- A survey by the North American Securities Administrators Association (NASAA) of state and provincial securities regulators showed 94% believed there was a high risk of fraud involving cryptocurrencies.

- Regulators also were unanimous in their view that more regulation was needed for cryptocurrency to provide greater investor protection.

- Cryptocurrencies and investments tied to them are high-risk products with an unproven track record and high price volatility. Combined with a high risk of fraud, investing in cryptocurrencies is not for the faint of heart.

- Investors should go beyond the headlines and hype to understand the risks associated with investments in cryptocurrencies, as well as cryptocurrency futures contracts and other financial products where these virtual currencies are linked in some way to the underlying investment.

- The acquisition of cryptocurrency coins may result in substantial risks for investors.

- As ICOs are a highly speculative form of investment, investors should be prepared for the possibility of losing their investment completely.

- The term ICO, stems from “initial public offering” (IPO), i.e. a floatation on a stock exchange. The apparent similarity of the terms gives the impression that ICOs are comparable to the issuance of shares. This is not the case, either technically or legally.

- In a recent interview published by the Federal Reserve Bank of New York, its economists Michael Lee and Antoine Martin raised the issue of the trustworthiness of such currencies.

- They highlighted the trustless nature as virtual currencies are not backed by anything real such as gold. Trust is implicit for practically any means of payment.

7. RBI still processing returned notes

- The RBI has said that Rs. 500 and Rs. 1,000 notes, returned to banks when the government demonetised high value currency 15-months ago, are still being processed for their arithmetical accuracy and genuineness.This is being done in an “expedited manner.

- Specific bank notes are being processed for their arithmetical accuracy and genuineness and the reconciliation for the same is ongoing. This information can, therefore, be shared on completion of the process and reconciliation,” the RBI said in reply to an RTI application.

- To a query on the number of demonetised notes, it said, subject to future corrections if any, arising in the course of verification process, the estimated value of specified bank notes received as on June 30, 2017 is Rs. 15.28 trillion (lakh crore).

- Asked to provide the details of the deadline for finishing the counting of demonetised notes, the RBI said specified bank notes are being processed in an expedited manner.

- As on date, 59 sophisticated currency verification and processing (CVPS) machines are in operation in RBI for the purpose, it said. The reply did not specify the location of the machines.

- The RBI will also soon have greater flexibility in terms of managing its liquidity operations with the addition of one more tool ‘Standing Deposit Facility Scheme’ to its kit. Finance Minister Arun Jaitley, in his Budget, had proposed to amend the RBI Act to empower the central bank to come up with an additional instrument for liquidity management. The proposal forms part of the Finance Bill 2018 which is scheduled to be approved by Parliament by March 31.

- “That is to provide one more tool for liquidity management. There is no more MSS (market stabilisation scheme),” Economic Affairs Secretary S. C. Garg told PTI.

- The RBI proposed in November 2015 the introduction of the SDF by suitably amending the RBI Act. This would provide the RBI a new tool for liquidity management, particularly in times when the money market liquidity is in excess to deal with post-demonetisation like scenario.

- CRR hike

- Post-demonetisation, the RBI ran out of securities to offer as collateral and had to temporarily hike its cash reserve ratio (CRR) to force banks to park extra deposits with it. The CRR is the portion of deposits that banks have to compulsorily park with the RBI. Currently, the CRR is pegged at 4%.

- When the liquidity position under the Liquidity Adjustment Facility (LAF) is outside comfort zone, the RBI uses an array of instruments to absorb/inject durable liquidity from/into the financial system

8. NITI bats for separate debt office at Centre

- NITI Aayog Vice-Chairman Rajiv Kumar made a strong case for setting up an independent debt management office, saying better servicing of loans could lead to substantial reduction in India’s interest payments.

- At present, government debt is managed by the Reserve Bank of India (RBI). The time has come to seriously consider better management of India’s debt servicing obligations.

- Interest payment is such a large part of the revenue expenditure that better management of debt servicing could substantially reduce interest payment.

- India’s external debt is only 18% of total GDP. When the RBI manages India’s debt then there is conflict of interest.

- Because, if more external people come and compete in government debt market, then we get more foreign exchange, therefore exchange rate management gets problematic.

- So, Debt market remains confined to few domestic players.

Category: ECOLOGY AND ENVIRONMENT

1. Three new eel species found in Bay of Bengal

- Scientists have discovered three new species of eel along the northern Bay of Bengal coast in the past few months.

- Dark brown with white dots on the dorsal side, Gymnothorax pseudotile was discovered at the Digha coast of the Bay of Bengal. The other two species,Gymnothorax visakhaensis (uniformly brown) and Enchelycore propinqua (reddish brown body mottled with irregular creamy white spots), were discovered from the Visakhapatnam coast of the Bay of Bengal.

- While Gymnothorax pseudotile is about 1 feet to 1.5 feet long, Gymnothorax visakhaensis is about a foot long. Enchelycore propinqua is the smallest of them measuring less than a foot.

- The specimens of the first two species can be found upon a considerable search, the third one is relatively rare.

- Eels are found mostly at the bottom of rivers and seas. Across the world about 1,000 species of eels have been identified. In India, the number is around 125.

- For species belonging to the family Muraenidae , referred commonly as Moray eels, there are records of about 200 species of which more than 30 species are found in India.

Five new species

- With these new discoveries, the Bay of Bengal coast has yielded at least five new species of eel. In 2016, Mr. Mohapatra and his team identified Gymnothorax indicus , an edible species.

- In 2015, a short brown unpatterned moray eel, named Gymnothorax mishrai(Bengal moray eel), was discovered from the coast of Bay of Bengal. The specimens of Gymnothorax pseudotile were collected in a trawl net by fishermen in the northern Bay of Bengal.

D. GS4 Related

Nothing here for Today!!!

E. Editorials

1. States of health: A new index by NITI Aayog

Which are the best performing states?

- States with a record of investment in literacy, nutrition and primary health care have achieved high scores in NITI Aayog’s first Health Index.

- Kerala, Punjab, and Tamil Nadu are the best-performing large States, while Uttar Pradesh, Rajasthan, Bihar, Odisha and Madhya Pradesh bring up the rear.

- States responsibility

- Health-care delivery is the responsibility of States; the Centre provides financial and policy support.

- Being able to meet the Sustainable Development Goals over the coming decade depends crucially on the States’ performance.

What is the purpose of the new index?

- The Index, with all its limitations given uneven data availability, hopes to make a difference here by encouraging a competitive approach for potentially better outcomes.

- For instance, it should be possible for Odisha to bring down its neonatal mortality rate, estimated to be the highest at 35 per thousand live births — worse than Uttar Pradesh.

- A dozen States with shameful under-five mortality rates of over 35 per 1,000 live births may feel the need for remedial programmes.

- What needs to be done?

- What the Index shows for the better-performing States is that their continuous improvements have, overall, left little room to notch up high incremental scores, but intra-State inequalities need to be addressed.

- Coming soon after the announcement of a National Health Protection Scheme in the Union Budget, the Index uses metrics such as institutional deliveries, systematic reporting of tuberculosis, access to drugs for people with HIV/AIDS, immunisation levels and out-of-pocket expenditure.

- The twin imperatives are to improve access to facilities and treatments on these and other parameters, and raise the quality of data, including from the private sector, to enable rigorous assessments.

- At the same time, as NITI Aayog points out, data on other key aspects lack the integrity to form part of a good composite index. Both the Centre and the States have the responsibility to scale up their investment on health as a percentage of their budgets, to be more ambitious in interventions.

- While the NHPS may be able to address some of the financial risk associated with ill-health, it will take systematic improvements to preventive and primary care to achieve higher scores in the Index.

- As the experience from countries in the West and now even other developing economies shows, socialisation of medicine with a reliance on taxation to fund basic programmes is the bedrock of a good health system.

1. Turf war

- The National Stock Exchange, the Bombay Stock Exchange and the Metropolitan Stock Exchange of India announced their decision to stop providing data feed and other support to overseas exchanges that list derivatives linked to Indian stocks and indices.

- Any existing agreement allowing data-sharing with foreign bourses, except that which is related to exchange-traded funds, will expire in six months.

- Explaining the reason, the statement said offshore derivatives could be causing migration of liquidity from India, which is not in the best interest of Indian market.

- Given that the volume of derivatives linked to Indian stocks trading in the offshore market is higher than volumes in the domestic bourses, Indian exchanges have enough reason to fear their foreign counterparts.

- Ambitious endeavours such as the International Financial Services Centre in Gujarat, although yet to gain the patronage of foreign investors, may also benefit from the crackdown on offshore derivative markets.

- Foreign bourses, however, will likely find other ways to list derivatives linked to Indian stocks and indices without any help from Indian exchanges soon.

- The present move, thus, is unlikely to rein in the vast offshore market for Indian derivatives. It also leaves a lot to be desired.

- Index derivatives such as the SGX Nifty that is linked to stocks that form Nifty, have gained the patronage of large foreign investors for many reasons.

- These instruments are traded for longer hours in offshore exchanges, including hours when Indian exchanges are closed for business, making them more investor-friendly.

- Places like Singapore and Dubai, where these derivatives are traded, are low-tax jurisdictions that offer investors the chance to lower their transaction costs as well.

- The fact that offshore derivatives are denominated in dollars adds to their allure.

- In India, in contrast, the securities transaction tax and the capital gains tax discourage foreign investment in financial assets.

- The proposal to extend trading hours in order to attract investors too has failed to take off.

- The statement by Indian bourses withdrawing support for offshore derivatives comes after an earlier decision by Singapore’s stock exchange, the Singapore Exchange Limited (SGX), to introduce in February futures on individual stocks that are part of Nifty.

- Incidentally, the SGX’s decision to introduce futures specific to stocks listed in the NSE was spurred by the Securities and Exchange Board of India’s decision last year to restrict foreign investment in domestic futures.

- Offshore markets are thus simply catering to the unmet demands of foreign investors.

- India’s policymakers should thus first of all address the structural problems that have caused trading in Indian derivatives to move offshore.

G. Practice Questions for UPSC Prelims Exam

Question 1. Consider the following statements:

- The World Government Summit is an annual event held in Dubai, UAE

- The first World Government Summit was held in Dubai in 2013, and has been held annually since then

Which of the above statements are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

See

Question 2. Consider the following statements:

- A sovereign wealth fund (SWF) consists of pools of money derived from a country’s reserves

- National Infrastructure and Investment Fund (NIIF) is a fund created by the Government of India for enhancing infrastructure financing in the country.

Which of the above statements are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

See

Question 3. Consider the following statements:

- Snow and Avalanche Study Establishment (SASE) is one of the laboratories of the ISRO located at Chandigarh.

- The SASE is the nodal agency for issuing advisories and warnings about the avalanche in the country.

Which of the above statements are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

See

Question 4. Consider the following statements:

- Kaziranga National Park is located in the State of Assam

- Kaziranga is home to the highest density of tigers among protected areas in the world.

Which of the above statements are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

See

Question 5. Consider the following statements:

- The Wildlife Protection Act, 1972 is an Act of the Parliament of India enacted for protection of plants and animal species.

- Schedule I and part II of Schedule II provide absolute protection – offences under these are prescribed the highest penalties.

Which of the above statements are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

See

Question 6. Consider the following statements about Lucky latitudes in Geography:

- This refers to the geographical regions where the practice of domestication of wild plants and animals began to happen for the first time in human history.

- People located in these geographic regions gained a headstart over the rest of the world.

Which of the above statements are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

See

G. UPSC Mains Practice Questions

GS Paper II

- The President of India in Indian democracy is more symbolic than substantive. Justify your view.

GS Paper III

- A community well prepared is the key to effective management of disaster. In the light of this statement examine the role of community and local Govt as first responders with suitable examples.

Also, check previous Daily News Analysis

“Proper Current Affairs preparation is the key to success in the UPSC- Civil Services Examination. We have now launched a comprehensive ‘Current Affairs Webinar’. Limited seats available. Click here to Know More.”

Enroll for India’s Largest All-India Test Series

Comments